According to 2017 research launched in June by LIMRA, a life insurance research study, discovering, and advancement company, majority (57 percent) of workers at business of all sizes ranked life insurance as a must-have benefit. It followed medical insurance, prescription drug protection, a retirement strategy, auto insurance, dental insurance coverage, and homeowner's protection. According to Glassdoor. com the wages for insurance coverage agents breaks down as follows: $35,560 $35,823 $35,560 $62,500 $59,608 $49,500 P&C agents who sell auto and property owners insurance typically make a commission based upon the policy premium. The commission varies from 5 to 20 percent on the very first year premium with a decreased amount frequently spent for renewals.

Brokers who offer life and medical insurance typically make a high first-year commission and lower commissions on specific health and life renewals. Compensation differs by product and, usually, life policy commissions are in the 40-100 percent variety of the first year's premium, with one to two percent for renewals. Often, after a couple of years, life commissions end all together. Medical insurance policy commissions have actually boiled down recently on lots of private and family policies, however the Kaiser Family Foundation states the nationwide payment average in 2013 was $12. 24 per member each month (pmpm). For brokers in the small group market, broker compensation was $19. How to become an insurance agent.

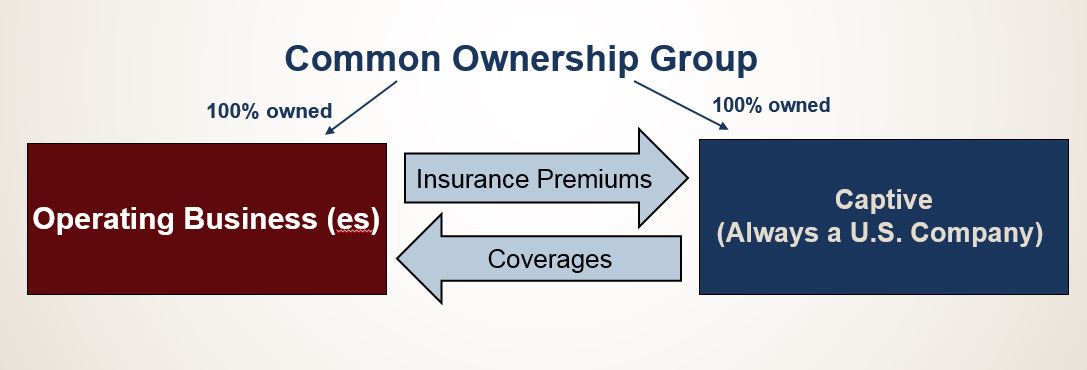

For big group health company, comp averaged $8. 15 pmpm. If you concentrate on group health insurance coverage, you'll be working with employers to help them discover protection for their business, employees, and, frequently, qualified member of the family. In this group expert role, you have the potential to make more than you may with private and family sales, since you're earning commission on every member in a group. If you work as a captive agent for a carrier or an independent marketing company (IMO), you may make a base pay and a commission on your sales. If your work as an independent agent, your earnings is probably to be solely commissions.

For example, a captive agent could make 10 percent commission on the sale of a P&C policy, while an independent agent might make 15 percent on an equivalent policy. That may appear like an irrelevant difference; nevertheless, if you write a half-million dollars in premiums during the year, the distinction is $25,000. An independent agent's commission arrangement might offer the exact same commission for the first 3 years coverage is in force (for instance, 15 percent in all three years). On the other hand, a captive agent could have a declining commission contract, making 10 percent notice of cancellation letter in the first year, followed by a lowered quantity (state eight or 6 percent in years 2 and 3).

Because premiums for health insurance vary from region to region, and since commissions are usually based upon premiums, the commissions you might earn will be affected by the location in which you live and operate. In https://www.taringa.net/kevotadlzb/8-simple-techniques-for-what-is-fdic-insurance_53qq5z the Kaiser Household Foundation payment analysis mentioned above, California brokers made more than the nationwide typical $15. 15 pmpm in the private market, $33. 85 pmpm for little groups, and $15. 89 pmpm for larger groups. In Nevada, the numbers were $14. 13, $26. 24, and $7. 14 pmpm, respectively. While there's talk about the ACA being replaced, there's no agreement on timing or the likely replacement.

The 45-Second Trick For What Is The Penalty For Not Having Health Insurance

That provides ongoing chances for you. Choose your specific niche, get your license, and start down the path to a brand-new profession.

The concern "just how much do insurance coverage representatives make?" is really broad. There are numerous answers depending upon the type of insurance they offer. The capabilities and work ethic of the representative also make a difference. The very first thing to consider is that 90% of people fail trying to make it in the insurance business. While the portion is high, it needs to not discourage people from the business. The overwhelming reason individuals fail is lack of preparation, reasonable expectations and work ethic. If you prepare and want to work hard, you can end up being an effective insurance agent. The next element to consider is the type of agent.

Having actually been an insurance coverage agent since 1998 and owning a company given that 2007, I can supply some prospective here. Independent representatives that last more than 5 years, make well over $100,000 a year. They construct a big renewal stream of earnings and as an outcome are able to see their income boost every year without required to work harder. This likewise depends on the type of insurance coverage being sold. We tend to prefer items that pay higher renewal or level commissions for the life of the product. Representatives using these item types will usually make significantly more cash with time due to the repeating profits.

Some insurance coverage plans pay nearly all of the commission in advance. Examples are term and Universal Life insurance (UL), last expenditure (FE) and annuities. While some UL and FE pay renewals, they are normally very low portions. Other items are more renewal based such as Medicare, Health Insurance, Long Term Care (LTC)*, Whole Life and Universal life policies. Agents selling more renewal based items will make much less in the first 5 years i won i tricked everyone however will make considerably more after that. Commission levels are standardized on some products such as Medicare Advantage and part D plans ( Click for Medicare benefit and Part D rx commissions).

I am generalizing a good deal here however the going rate for life insurance coverage is typically around 75% to 95% street depending upon the business and item type. Last expense runs in the 90% to 110% depending on the company. It is much harder to get a base line on things like health, oral, vision, short-term health and other ancillary lines. They tend to vary a good deal depending on the business. * A variety of LTC providers have just recently left business and/or have actually stopped paying agent commissions. Please call our workplace for a list of existing LTC companies still paying representative commission.

Some Ideas on How Much Is Health Insurance A Month You Need To Know

Agents just require to complete file to agreement with any carrier they desire. No requirement for additional documentation when including any brand-new carriers. CLICK HERE FOR CONTRACTING We provide a Medicare lead program to representatives- Click to find out about our complimentary lead program.

It's not a surprise that offering life insurance coverage is such a popular occupation. With over 1 million insurance agents, brokers, and service employees in the united states in 2020, it stays one of the largest markets. One of the benefits of offering life insurance are the flexible hours. You can do it on the side initially and earn an excellent living if you are prepared to put in the work. Are you a people individual? If so, then you ought to not have any issue selling insurance items. It includes making call, setting visits, following up, and getting informed NO (How much is car insurance per month).